|

home | what's new | other sites | contact | about |

||

|

Word Gems exploring self-realization, sacred personhood, and full humanity

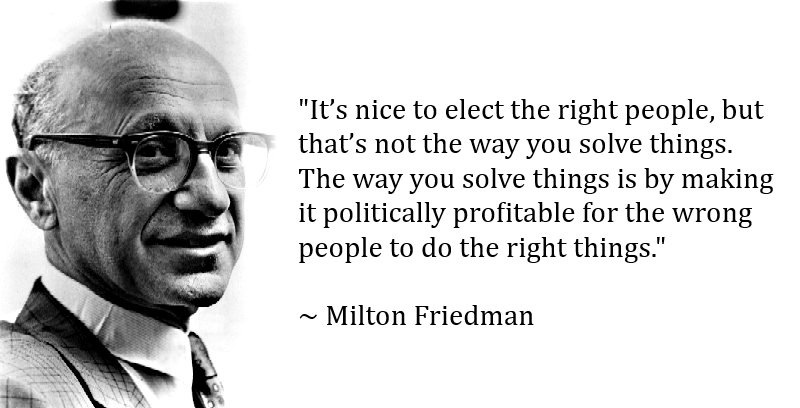

Milton Friedman Free To Choose The Tyranny Of Controls

Dr. Friedman was one of the great teachers of my life. His lectures, when I was a young man, helped me to break the chains of cultism. I must add, however, concerning his “wrong people” finding it “profitable” to do “right things,” this half-hearted observance of moral action is built upon the assumption that even the wayward will act according to what’s good for them. But what if some don’t care about what’s good for them? What if their level of consciousness is so basement-level that they would invite chaos and destruction, even to themselves, if only others might be taken down, as well? This “madness maddened” represents the world of the perversely shameless, those utterly lost to wanton audacity and gross impropriety. Not even Adam Smith can save them. READ MORE on the ‘levels of consciousness’ page.

Friedman: It is harvest time and Japanese farmers gather their crops for the rice market in Kyoto. Of course, they will try to get as much for it as possible and the buyer's will try to buy it as cheaply as possible. That is how markets are supposed to work. That is what Adam Smith, the Scotsman who turned economics into a modern science, observed 200 years ago. He observed something else too. Adam Smith: In every country it is always and must be in the interest of the great body of people to buy whatever they want of those who set it cheapest. The proposition is so very manifest that it seems ridiculous to take any pains to prove it. Nor could it ever have been called in question had not the interested sophistry of merchants and manufacturers, confounded common sense of mankind. Their interest is, in this respect, directly opposite to that of the great body of people. Friedman: Adam Smith's flash of genius was to see how prices that emerged in the market, the prices of goods, the wages of labor, the cost of transport, could coordinate the activities of millions of independent people, strangers to one another, without anybody telling them what to do. His key idea was that self-interest could produce an orderly society benefiting everybody. It was as though there were an invisible hand at work. The invisible hand is a phrase that was introduced by Adam Smith in his great book, The Wealth of Nations, in which he talked about the way in which individuals, who intended only to pursue their own interests, were led by an invisible hand to promote the public welfare which was no part of their intention. He was talking about the economic market. About the market in which people buy and sell. He was pointing out that in order for a butcher or a baker or a candlestick maker to make an income, he had to produce something that somebody wanted to buy. Therefore, in the process of promoting his own interests and looking to his own profit, he ended up serving the interests of his customers. When Adam Smith published The Wealth Of Nations, Britain was still a largely rural and placid place. But the Industrial Revolution was already getting started and standards of life were beginning to rise. One obstacle was that trade with other nations was still tightly controlled. Merchants in the home market had persuaded the government of the day to impose heavy duties and taxes on all foreign imports in order to insure themselves a protected market. One of the results was to turn Britain into a nation of lawbreakers. Smuggling was a national past time: brandy, wines, tobacco, anything with a heavy customs duty on it. For years, the revenue men fought a losing battle along the shores and inlets of the British Isles. In 1846, after years of argument and partial success, the followers of Adam Smith finally persuaded the British Parliament to remove all duties on goods imported from abroad. Britain embarked on complete free trade, giving a further push to the rising standard of life. What happened in Britain as a consequence of releasing the tremendous force of self-interest, had the unintended effect of benefiting millions of people all over the world, and by 1851 the evidence was proudly on show at the great Crystal Palace Exhibition. Free trade enabled Britain to become the work place of the world. But was it all an accident? I don't think it was. Consider what happened in 1868 on the other side of the world in Japan. For the preceding 300 years, the Japanese had lived in almost complete isolation. They had discouraged visitors from other nations, especially from the West. The result was that by the standards of the West, Japan was backward. It was a feudal society with lords and serfs and woe betide anyone who tried to change the order of things. Women were third class citizens. In 1868, a new generation of rulers decided that the time had come for Japan to make contact with the outside world. And with the arrival of the first foreign traders from the West, things began to change. The Japanese followed the British trading pattern because Britain was a leading nation of the world. So free trade came to Japan. Japan became a magnet for other people's ideas and developments. One of the first traditional industries to feel the effects was weaving. From Europe, the Japanese imported the jacquard method __ a way of programming a loom to control the accuracy of the weave, and so the standardized output. Workers did well in the new atmosphere and so did their employers. The adoption of mass production techniques meant that workers were able to move out of the traditional industries and into the new industries, which all added to the trade boom. None of us can help being effected by the intellectual atmosphere that we breathe. In the middle of the 19th century, when Japan ended her self-imposed isolation and entered the modern age, it never occurred to her leaders to follow any other course than that of free enterprise and free markets. That was the intellectual atmosphere of the time, created by Britain's success in applying the principles of Adam Smith. In 1948, when India achieved independence, her leaders had all been trained in Great Britain. They had sat at the feet of Harold Laski and his associates at the London School of Economics, or of their counterparts at Oxford and Cambridge. It never occurred to them to follow any other course than that of central planning and government control. That was the intellectual atmosphere of the time. The intellectual seed took root. As it grew, it needed to be honored, even worshiped. Every year on the anniversary of Gandhi's birth, people all over India do just that __ in homage to the great Mahatma, they sit and spin using methods handed down through the centuries. But it is more than just a symbol of honoring the past. It typifies the policy that they are actually following. The new government in 1948 decided that India's traditional weaving industry and its workers should be protected from 20th century industrialization. What were the consequences of that policy? This is India today, 30 years after winning independence. These are scenes of a very typical Indian community __ one of thousands. It is called "Anicaputar" and it is about 1,000 miles south of the capital, New Delhi. This is not the kind of life the government intended to perpetuate. But it is one result of their policy. By subsidizing the cotton that the villagers spin and the cloth that they weave, they made it difficult for modern industry to develop. This is sizing. It's an essential technique in cloth production where the yarn is smoothed clean. A modern machine could do the same thing in a hundredth of the time. The result of government planning to modernize industry is that the number of hand looms roughly doubled in the first thirty years after India's independence. Today, in thousands of villages throughout India, the sound of hand looms can be heard from early in the morning until late at night. In this village alone, there are more than 3,000 hand looms in operation. Since 1948, three generations of villagers have sat at these looms making cloth with patterns that never vary, using methods that never change. There is nothing wrong with this activity, provided it survives the test of the market, provided it is the way in which these people can use their abilities and their energies most effectively. After all, in Japan, where the government has not specially encouraged the hand loom industry, there remains a very small, but very productive hand loom segment. The trouble here is that this industry exists only because the government has subsidized and supported it because it has in effect imposed taxes, direct and indirect, on the rest of the people of India, people who are no better off than these people are in order to enable this activity to continue. Other industries, both textile industries and industries of a variety of kinds, have been restricted, explicitly kept back, prevented from providing more productive employment in order to make room for this industry. The effect has been to inhibit the development, to prevent the growth, to prevent the dynamic activity that could otherwise develop out of the energies and the abilities to the people of India. This looks like a factory, but it is also home for the people who work here. When they are not sitting at their looms, they eat and sleep in a corner of this hut. Throughout the world, governments always profess to be forward-looking. In practice, they are always backward-looking. Either protecting the industries that exist, or making sure that whatever ventures they have decided to undertake, are encouraged and developed. This occurs at the expense of the kind of healthy development of new, dynamic, adapted industries that would surely occur if the market were allowed to operate freely. If it were allowed to separate out the unsuccessful ventures from the successful ones. Discouraging the unsuccessful and encouraging the successful. India has tremendous economic and human potential, every bit as much as Japan had a century ago. The human tragedy is that in India, that potential has been stifled by the straightjacket imposed by an all-wise and paternalistic government. Central planning, in practice, has condemned India's masses to poverty and misery. We know what has happened in Japan. Free trade set off a process that revolutionized Japan and the lives of its people. Improvements in material wellbeing went hand in hand with the elimination of the rigid social structure of a century ago. It's no accident. As always, economic freedom promotes human freedom. And in the meantime, what has happened to the Japanese weaving industry? This is how textiles start life in a Japanese weaving shed today. A design for cloth is placed on a drum. As it revolves, it is scanned by an electric eye. Each color, each variation in the pattern and texture is transmitted faithfully to a computer. It's all that the modern loom of Japan requires. This loom is fitted with electronics that make it one of the most sophisticated of its sort in the world. The fabric that it produces is the best silk of its kind. Thanks to the speed and efficiency of these machines, the price of the silk is competitive. The workers are highly skilled and well paid. With the new technology, there is very little __ a loom like this cannot produce. This piece will become the sash of a traditional bridal gown. These are machine-made products. But by any standards, they are beautiful. They can stand comparison with the very finest work of the hand loom. And it's not merely the end product itself that is remarkable. The sophisticated technology which was developed to make all of this possible, has been adapted to other processes. Part of the self-generating development under free enterprise, and it all stems from an ancient, traditional industry __ weaving __ that imported a new method for controlling its looms when Japan turned to free trade more than a century ago. Yet, believe it or not, many still maintain today that markets cannot be left to operate freely. That they must be controlled by government. This dockside is in Scotland, a British government, a socialist government decided that its role was to protect the workers here from competition. So down there in governed shipyards, they are building these vessels for the Polish government. To get the order, the British government is using the money of British taxpayers to subsidize the work. In other words, British people are making these ships in order to sell them at a loss to the Poles. Not only the Poles, but we also in America benefit from this kind of philanthropy. The steel industry in the United States makes a fine profit. Other countries do too. And their steel is often cheaper, sometimes because their taxpayers subsidize it. So, why shouldn't the American consumer buy steel wherever he can get it cheapest __ at home or abroad. The American steel industry works very hard trying to persuade us that it's not in our self-interest to buy in the cheapest market. They urge the government to restrict what they call unfair competition, though, of course, they recognize that there are dangers in this. Richard P. Simmons, Industry Specializing Steel Committee: The dilemma of asking our government for assistance in this problem of unfair competition bothers many of us because the sword does cut both ways. But we believe that what we have attempted to do is far different than the kinds of direct government involvement that occur in many of the foreign nations around the world where the governments provide direct financial assistance in the form of either ownership or loans or subsidies in some fashion or another. What we have attempted to do is simply to get our government to enforce the United States laws against unfair competition that have been on the United States' books. We draw clear distinction between that and, for example, the several hundred million dollars that the French government has granted to the French steel companies, or that the British Steel Corporation has received $1.3 billion for capital investment this year. So that while we are uneasy in any way interfacing with our government in what we traditionally believe are the free enterprise prerogatives, yet what we are only asking for is that the government enforce the laws that our Congress has passed. I'm not sure that's really any different than asking someone to arrest someone that commits a crime. I don't think we would be accused of being reactionary if we reported somebody who was stealing, to the police if it were in violation of a U.S. law. We think that we're doing exactly the same thing when we bring cases against foreign producers who we believe are violating U.S. laws. Friedman: The fallacy with that argument is that it begs the real question. Why should there be laws that in effect prevent you and me from buying in the cheapest market? When anyone complains about unfair competition, consumers beware. That is really a cry for special privilege always at the expense of the consumer. What we needed in this country is free competition. As consumers, buying in an international market, the more unfair the competition the better. That means lower prices and better quality for us. If foreign governments want to use their taxpayers money to sell people in the United States goods below cost, why should we complain? Their own taxpayers will complain soon enough and it will not last for very long. History provides lots of evidence on what happens when government protected industries compete with industries who have the operate in an open and free market. It's almost always the government protected industries that come out second best. Ask Sir Freddy Laker, the Englishman who introduced low cost air traffic across the Atlantic. Who were his chief competitors? They were all government protected, government financed, government regulated airlines. He came out very well, made a mint of money. And you and I have gotten cheaper travel across the Atlantic. Nothing would promote the long run health of the steel industry, make it into a more efficient, profitable and productive industry than for the U.S. government to keep its hands off, neither providing special privileges, nor imposing special restraints. And what is true for the steel industry is true for every other industry in the country. These women work in an industry that so far hasn't asked for special protection __ the silicon chip industry. Every one of these small squares on this disk is a highly complicated and integrated micro circuit. An American technician examines them for defects. It is highly skilled work and she's had a lot of training. When she has done her job, the rejects will be separated from the rest and the good circuits will be packed up and sent half way around the world to Malaysia. The product of American technological skills returns looking like this. Each micro circuit has been enclosed in ceramic by a Malaysian worker who is highly productive at this sort of work. But, the Malaysians are not able to test their product so back they come here to America to be fed into these machines. American engineers are good at producing sophisticated machines. In an operation that lasts a fraction of a second, these machines can test every circuit, can grade it for quality, and then can sort it into one of six different categories of reliability. The invisible hand in this free market has done wonders for both the American girls and their Malaysian counterparts. And that's not the end yet because American silicon chips are exported to many countries where foreign workers assemble them. The final product is then returned to our stores so that you and I, the consumers, can benefit from $10.00 calculators, as well as from a lot of other electronic devices that not long ago simply did not exist. When this Hi-Fi equipment first came on the market, only the rich could afford it. But even when the international market and labor seem to work to everyone's advantage, people still put up arguments against it. The usual argument against complete free trade is that cheap labor from abroad will take jobs away from workers at home. Well, what is cheap? A Japanese worker is paid in yen and American workers paid in dollars. How do we compare the yen with the dollars? We need some way of transforming the one into the other. That is where the exchange rate enters in __ the price of yen in terms of the dollar. Suppose that some exchange rate, Japanese goods are in general cheaper than American goods, and we will be buying much from Japan and selling little to them. But what will the Japanese do with the extra dollars they earn? They don't want to buy American goods. By assumption, those are all dear. They want to buy Japanese goods. But to buy Japanese goods, they need yen. Calls will come in from all over the world to places like this, offering to buy yen for dollars. But there will be more offers to buy yen than to sell yen. In order to get customers, those offering to buy will have to raise the price. The price of yen in terms of dollars will go up. As you remember, that is what happened in 1977 and 1978. By late 1978, it took 50% more dollars to buy a given amount of yen than it had taken a year earlier. But what happens when the price of yen in terms of dollars goes up? Japanese labor is no longer so cheap. Japanese goods are no longer so attractive to American consumers. On the other hand, American labor is no longer so dear to Japanese. American goods are more attractive to the Japanese. We will export more to them. We will import less from them. New jobs will be created in export industries to replace any jobs that might have been lost in industries competing with imports. That is how a free market and foreign exchange balances trade around the world when it is permitted to operate. The problem is that more often than not free market is not permitted to operate. For reasons that seem to make sense if you don't examine them carefully, government insists on interfering, but when they do it's not possible to hide the harmful effects for very long. The main reason why the Japanese yen went up so sharply in price in 1977 and 1978 was because the Japanese government had been trying to prevent the yen from going up in price. In the process what might have been small disturbances were allowed to accumulate into a major gap in trade. As a result when market forces were finally permitted to operate, as sooner or later they must be, it took a major change in the yen exchange rate to bring things back into life. Why don't governments learn, because governments never learn, only people learn, and the people who learn today may not be the people in charge of economic policy tomorrow. As you contemplate this, you may come to agree with me, that what we need are constitutional restraints on the power of government to interfere with free markets in foreign exchange, in foreign trade, and in many other aspects of our lives. DISCUSSION Participants: Robert McKenzie, Moderator; Milton Friedman; Richard Deason, International Brotherhood of Electrical Workers; Donald Rumsfeld, President, G.D. Searle & Company; Helen Hughes, Director of Economic Studies, World Bank; Jagdish Bhagwati, Professor of Economics, MIT McKENZIE: Now, here in Chicago, the special guests who have been watching that film have their say. DEASON: This film has set me on edge. There is political, social, ethical considerations which do not reflect in the economic philosophy put out. There is a pervading feeling in this that the individual worker is to be totally sacrificed for the overall good of society. I see __ I don't see how possibly you can sacrifice individuals' for overall good of society because society is nothing but those millions and millions of individuals, put together. And nowhere is there any consideration given to the social and the ethical aspects of the free trade formula that you advocate. McKENZIE: Let's get other views now, around the group. What's your reaction, Don Rumsfeld, as a businessman, to the idea that Milton Friedman's advanced, that America ought to buy in the cheapest markets, the cheapest goods, without protecting against them? RUMSFELD: I swore I would never even try to defend Milton Friedman. And I won't. But let me comment, first, on Dick's comment. It bothers me to hear social and moral arguments invoked in an issue like this, because it seems to me the measure is what actually happens to human beings. Each individual ought to be concerned about humanity. For a single individual who is unemployed, that's a hundred percent unemployment. DEASON: Absolutely. RUMSFELD: And we recognize that. I recognize that. But the real world is, if you, as the film did, go to India, if you want to see things that one can describe as inhumane, and poverty, and problems of human beings, they exist. And the test ought to be, what works? What, in fact, will provide a circumstance that will be more than dynamic, and more productive in the world? HUGHES: It is true that in the long run we would all be better off with free trade. I agree with Milton. But it's the short run that matters, and in the short run there are serious adjustment problems. Now there's no question that the developing countries need access to markets such as American markets. And America needs them to export so that they can export more to developing countries. American exports to developing countries have moved from something like twenty percent of total exports to thirty percent over the last ten years. But the adjustment is important, because what is happening at present is that it's not just a random group of workers that is affected by this trade, it's the most disadvantaged and underprivileged workers in America which are being affected; and they are, by and large, women, and members of minorities; in garments, in electronics. And I think that the adjustment consists of action on both the developing and the developed country sides. From the __ let's take the American side. On the American side, the unions and industry, I think, have to get off discussion about moral issues and get their act in order. BHAGWATI: I couldn't agree more with Helen. I think there is a very valid income distributional problem involved here. Certainly society gets better off, consumers get better off as a result of cheaper imports, and I'm all for that, and there I agree completely with Milton. But if the incidence of the adjustment falls on disadvantaged groups, then you would want to do something about it, if this really becomes an ethical issue. But the other thing which I think Milton does bring up, which I disagree sharply with is: Suppose the foreign governments do subsidize and actively promote exports to you. Should you just sit back and just say, "Well, we're going to be better off as a result of this"? I don't think that takes into account the fact of the whole international system can break down as a result of what people perceive in pluralist economics as unfair competition emerging. And I think this is really what you're beginning to see. So we do need some sanctions. I mean, I may receive stolen property, and I'm better off. Of course I'm better off. But if, as a result of this, I encourage theft, I think few people would agree that was something one did want to worry about. McKENZIE: Before I call in Milton Friedman on this, a reaction to the comments? DEASON: Yes. Really to Don and to Helen. Don, you choose to set aside, or you appear to choose to set aside the social and the ethical considerations. And __ RUMSFELD: Not at all, what I said was: You have to put the fact on a scale, that there are social and ethical considerations with a free market or without one. And the tendency is for people to invoke morality only on their side, and not to recognize that there are problems of human beings in this world that are going to occur in each case. And the measure, or the test ought to be, what actually happens out there and address that question. DEASON: But you must, you must also very much consider the social aspect of this situation. Helen's comment, the short-term displacement. I have a question for Milton at this point: How long do you put as a timetable on the displacement of these people, of these workers? Five years, ten years, a generation? How long will it be before overall society, you know, balances itself out and the individual is no longer hurt? FRIEDMAN: Let me take your first __ your last question first and then go to your basic question. I have always been in favor of phasing out tariffs over a five year period, a twenty percent reduction a year for five years to give people time to adjust. Now to your fundamental issue. I thought I had heard every objection to my views imaginable, but you are the first one who has ever accused me of putting the interests of society as a whole ahead of the interests of individuals. If there is one element in my social philosophy, in my ethical philosophy that's predominant, it is that the ultimate unit is the human being, the individual, and that society is a means whereby we jointly achieve our objectives. I would argue that the social and moral issues are all on the side of free trade, that it is you, and people like you, who introduce protection, who are the ones who are violating fundamental social and moral issues. Tell me, what trade union represents the workers who are displaced because high tariffs reduce exports from this country? Because high tariffs make steel, for example, or other goods, more expensive, as a result, those industries which use steel have fewer __ have to charge higher prices, they have fewer employees, the export industries that would grow up to balance the imports __ tell me, what union represents them? What moral and ethical view do you have about their interests? McKENZIE: Richard Deason. DEASON: You still haven't answered my basic question: How long of a time period, how long of a frame __ five years, ten years, a generation? You still haven't answered it. FRIEDMAN: I said __ I said five years. DEASON: Five years __ McKENZIE: Could we be clear, Milton, on this point. You're saying, though, that tariffs should be phased out over five years regardless of the action of other countries. It's not a sort of negotiation or anything else? FRIEDMAN: Regardless. Regardless of the actions of other countries. So far, obviously, I would prefer to have other countries reduce their tariffs __ McKENZIE: But if they don't move, America should move? FRIEDMAN: Absolutely. McKENZIE: Do you go along with that, Don Rumsfeld? RUMSFELD: In others words, you're against reciprocal __ FRIEDMAN: I'm not against __ RUMSFELD: __ you favor getting to truly reciprocal trade, but you're willing to get there unilaterally? FRIEDMAN: Yeah. RUMSFELD: Yeah. It seems to me that it's probably worth moving in that direction. I don't know where I would stop. I am not __ McKENZIE: Well, it's a five year program. Will you buy that? RUMSFELD: Well, it seems to me that you get action, reaction. To the extent you're doing something that makes sense for human beings, presumably, that would be persuasive with others. Presumably there would be a logical sequence where other countries would begin to sense that had a certain degree of validity in the world. McKENZIE: Will that happen, Helen Hughes? HUGHES: Providing you do something for the displaced workers in the country in which they're displaced. Because if you don't do something, if you don't take some action, and it's generally got to be government action, you will get such a backlash that you'll be back in the thirties with the sort of thing that happened with high unemployment. McKENZIE: Could we go __ Milton. There's a direct challenge. What would you do about displaced workers, or let the slack be taken up by other __ FRIEDMAN: I believe that you have to separate, and should separate sharply the issue of what you do about people in distress, from how you handle the industrial system. I do not believe you ought to have a special program for displaced workers. What you ought to have, and what all societies do have, is some mechanism, voluntary or governmental, which will assist people in distress. We have another program in this series which deals with exactly that issue, in which I come out, as you know, in favor of a negative income tax as a way to do it. But I think it's a great mistake to try to link it directly with tariffs. And the reason is that many people who are displaced are not in trouble. Many of those have good alternatives. Some of them will benefit from it. There are some who will be in distress, of course, but there are always people who are in distress for all sorts of reasons. In a dynamic society, demands are going up here, demands are going up there, there is no more reason in my opinion to have a special program for those who are displaced because of the changes in demand and supply in the international scene, than because of the changes on the domestic scene. McKENZIE: A quick reaction to that __ DEASON: Why would you want to return to a concept that this country exists, you know, had in 1900? Why would you want to return to where a few control the economic destiny of every working man and woman? FRIEDMAN: It's exactly the other way, Mr. Deason. The best way to limit the control of a few is free trade on a worldwide basis. There is no measure whatsoever that would do more to prevent private monopoly development than complete free trade. It would do __ be far more effective than all the antitrust suite in the world. DEASON: I totally disagree. You would wind up with a situation like in the movie Rollerball, where corporations carved out their spheres of economic influence throughout the world, and controlled everything. It would be controlled by corporations __ FRIEDMAN: You saw the __ DEASON: __ in its entirety. FRIEDMAN: Excuse me. You saw the picture of Hong Kong, didn't you? DEASON: Yes. FRIEDMAN: Where are those corporations there? McKENZIE: We might get down that alley and have difficulty in finding our way out of it. Could we move to another big theme in the film: that is, that the third world countries have, broadly speaking, made a very serious error in moving into planned economies, from beginning to end, and you use a phrase in the case of India, "Central planning has condemned the Indian masses to poverty and misery." Now, what's your reaction to that, sir? BHAGWATI: I partly agree with Milton as well as I largely disagree with him. I think it is true that the invisible hand ought to be seen more in the poor countries, (Laughter) than it is, and I would like to see the iron fist disappear. Unfortunately, it's the other way around. On the other hand, I think it cannot be maintained that laissez faire is the answer, either that it's a necessary or a sufficient condition for development. Let me go to Milton's examples and, you know, refer to Japan. Japan is a prime example, actually, of where the visible hand is invisible to everybody who is outside of Japan. But it's writ large on the wall for the Japanese. The Japanese government, right from the major restoration, has taken a very active interest in the development of the country. It has regulated technology and imports. Even to this date the government and business have a strong symbiotic relationship. I think it's just __ McKENZIE: Highly paternalistic. BHAGWATI: __ and business is highly paternalistic. I don't think it's a valid example at all of what I believe was the implication of Milton's program. McKENZIE: Let's bring in Helen Hughes. On this theme, has the third world made a disastrous mistake in almost unanimously moving into planned economies rather than the free market? HUGHES: Well, first of all, it hasn't almost unanimously moved into planned economies. McKENZIE: Overwhelmingly so. HUGHES: Not even overwhelmingly. I mean, India is a large country, but the majority of developing countries are not centrally planned. They have some sort of planning, and secondly, some of the countries which have been most successful have had the highest government intervention. The best examples are Taiwan, Korea, Brazil, Singapore. And even in Hong Kong, which is often held up as an example of no government intervention, I mean this is just not true. The Hong Kong government has provided the infrastructure. It has provided the roads and the ports and schools. And it's been very important. But when you move to a country like Malawi or Papua New Guinea, you can't do without government intervention. There is nothing there. There are no entrepreneurs in place, and the American entrepreneurs are not interested in small places like that. FRIEDMAN: I'm not in favor of no government intervention. I never have been. I point out in the film that what the government did in Hong Kong was very important. The question is: What kind of intervention? And in the states you've described, in the places you have described where you've had success, governmental intervention has been of a rather special kind. It has provided infrastructure. It has not tried to determine the outline of industrial production, the areas in which industry should go, exactly what the allocation of __ it has not gone in for central planning. HUGHES: Well that's just not true in Korea. I mean, you are factually wrong because in Korea the government has actually __ FRIEDMAN: Oh, it is true in Taiwan. HUGHES: It's fairly true in Taiwan, but not in Korea, which has grown faster than any other country. Where Korean exports have been determined to a very large extent, by direct government intervention. I think your point is, what sort of government intervention, what for, and what are the tradeoffs between government intervention and the free market. These are the relevant issues. McKENZIE: What is the role of government in relation to the market economy? How do you see it performing, Don Rumsfeld, do you want to see government, as it were, enforcing competition by chasing down monopoly, restrictive practices, and all the rest of it in the society? RUMSFELD: The record's clear that they don't do it well. They can't manage the __ McKENZIE: But does that mean they shouldn't do it at all, or do it better? RUMSFELD: Take the wage price controls in the United States of America, I happen to have been involved, and I don't say it with any great pride. The real world is __ I don't care about good intentions, I don't care about brains, I don't care about integrity, the fact of the matter is they're not smart enough to manage the wages and prices of every American, 215 million strong. They can't do it well. They do it poorly. And the weight of that is harmful. It's graphically shown in every document issued by the Council of Economic Advisors in the United States. McKENZIE: But what about the additional question, though, does the government properly, in this or elsewhere, insure competition by other devices. I'm not talking now about price control, wage control, but insuring competition rather than permitting price fixing or agreements and monopoly. What do you feel about it? DEASON: I feel the government properly acts in that area. It must __ the government must be there to insure competition. RUMSFELD: The government's not smart enough __ look at the Antitrust Law. You talk about a patch __ the implementation of antitrust regulations in the United States, between the Department of Justice and the FTC. It's a __ it's a patchwork mess. There isn't any logic to it. People don't know what to do. They don't __ they can't get answers. They're inhibited from mergers and consolidations that would make a lot of sense from the standpoint of the consumer. DEASON: And would make even more sense from the point of multinational corporations. HUGHES: I think that one of the points you're making is that it's very hard for the government to intervene in a very large country, like India or the United States. But compare government intervention in some of the small, homogenous countries of Europe or Singapore, and I think that's very important. Switzerland has a great deal of government intervention. Sweden, Denmark, Norway __ I've just quoted you the four highest income countries in the world. They do have intervention to try and protect the functioning of the market system, and to make it more efficient. BHAGWATI: Milton is absolutely right, that if you're talking about central planning that has been disastrous. Absolutely, in terms of having targeted industrial allocations and so on; I mean there's absolutely no doubt in anybody's mind who has studied the problem over the last twenty years. McKENZIE: Disasters in India, too. BHAGWATI: In India as well, very definitely. McKENZIE: You advised on that, didn't you? BHAGWATI: No, not on centralized planning, no. (Laughing) RUMSFELD: That wasn't a clear question anyway. (Laughter) FRIEDMAN: That's all right. I was over there as an advisor, too. BHAGWATI: I'm on the side of the angels on that. For a number of years __ I'm supposed to be a friend of Milton's there, which is disastrous. (Laughing) DEASON: To give advice is one thing. To have it taken is a different one. FRIEDMAN: I agree very much with what Helen Hughes has said, that the more homogenous the country, the less harm the government will do by intervening. I don't believe it does positive good. I just simply believe it does less harm. But, as to antitrust __ McKENZIE: Yeah. FRIEDMAN: I am in favor of the laws which make agreements and restraint of trade illegal. McKENZIE: Yes. FRIEDMAN: Most of the rest of the antitrust apparatus has promoted monopoly instead of hindered monopoly. If you look at where there are monopolistic elements in the world, and in the United States, including the multinationals you want to refer to, in almost every case that monopoly derived from a special grant by government. And therefore, the problem is not how does government enforce competition, how do you keep government from setting up monopolies? That's the real problem, if you look at the real world, and not at the preamble, the language, of antitrust measures and similar laws. McKENZIE: How close are you to what Deason was saying a moment ago in this area? He would seem to be arguing with you that there was a responsibility to make competition work. FRIEDMAN: The responsibility is to set up a framework of laws and of arrangements, under which competition will flourish. And the most __ McKENZIE: Inevitably flourish? I mean, or __ FRIEDMAN: Well, so far as I know, I don't know of any case in history in which monopolies have been able to maintain themselves for very long without having government assistance directly come in on their side. The trade union monopolies that Mr. Deason represents would never have the kind of power they do now if it weren't for the special privileges which government has granted to them. I can perfectly well understand his being in favor of such action, of antitrust action by the government, because it really is pro-monopoly action, in the main. DEASON: Why were those exemptions to monopoly laws given to unions? FRIEDMAN: Because of the political power of unions, of course. I'm not questioning that. DEASON: and because __ and because of the tremendous imbalance of power of companies at the time that unions were getting their start. McKENZIE: There's one concluding idea toward the end of your script that I'd like to look at, because it seemed to me to be most provocative. You talked about the need for constitutional restraints on governments to prevent them interfering in foreign exchange free markets, and in foreign trade. Now what have you in mind, Milton, when you say "constitutional restraints"? FRIEDMAN: I __ no doubt what I have in mind if I, if I could persuade the public, I would like it to adopt a constitutional amendment strictly parallel to the constitutional prohibition in the text of the constitution, against the central government __ I'm sorry, against state governments imposing tariffs on imports. I would like to have a constitutional amendment which would read, "The Congress shall not impose any taxes, any taxes on imports, or give any subsidies to exports, except such as may be necessary," I think the wording of the constitution is that the states are permitted to do it if it's necessary for inspection. That's the excuse under which California inspects you every time you drive past to see whether you're carrying any plants or fruits or vegetables. DEASON: Milton, let me ask you a question: How long do you think that the United States would survive if the United States enacted what you would like to have? FRIEDMAN: I think the United States would prosper in a way that is hardly imaginable today. It would be an example and a beacon to the rest of the world. What kind of sense does it make, here we are supposedly the leaders of the world. We are the ones who promote freedom, and free enterprise, and individual initiative. And what do we do? We force puny little Hong Kong to impose limits, restrictions on its exports at tariffs, in order to protect our textile workers. We go to Japan, and we say to Japan, "For God sakes, you got to limit the number of television sets you come out." Instead of doing that, we ought to be setting an example to the world, and if we set the kind of an example to the world that Great Britain set to the world in the 19th century, it would be a tremendous __ it would have a tremendous impact, it would strengthen our moral position in the world, it would strengthen our ethical position in the world. Instead of giving money to underdeveloped countries to produce products which we then refuse to buy and don't let them export to us, we would be saying to the rest of the world, "If you produce anything, if you can produce anything and have a market here, come, we're delighted to buy it, and we'll produce things for you to buy." That's the kind of a pattern I would like to see the United States establish. McKENZIE: Would your members buy that? DEASON: Never. That's a __ FRIEDMAN: Never is a long word, sir. DEASON: Yes, you're right. FRIEDMAN: __ and you must distinguish between __ DEASON: And one should never say never. FRIEDMAN: Your union officials would not buy it. But I am not sure your members wouldn't. DEASON: My members would not. No. My members would never buy it either. I cannot conceive of the United States setting itself up to become a target for the rest of the world. FRIEDMAN: It's not a target. DEASON: There would be absolutely nothing that would require or compel any other country to enact any reciprocal agreements relative to tariffs__ FRIEDMAN: That's right. DEASON: __ and until such time as they have succeeded in dumping in the United States __ and I used dumping in the broadest sense of the word __ any and every product, either government subsidized by a foreign government, either put there because of multinational corporations manufacturing facilities in a foreign country, until they have succeeded in absolutely draining us dry __ FRIEDMAN: Draining us dry of what? DEASON: Of every __ of every asset. FRIEDMAN: How? DEASON: Of every __ FRIEDMAN: What would they do with the dollars they got? DEASON: They'd probably buy up, as they are now, as they __ FRIEDMAN: If they bought up __ RUMSFELD: The choice farmland. FRIEDMAN: Yes. Yes. McKENZIE: Let's broaden this. On this very argument, now and a constitutional amendment argument. We've learned from our union friend he would __ can't sell it and won't sell it. Would business buy it? RUMSFELD: Oh, no! They __ speaking __ (Several people talking at once.) RUMSFELD: I'm not saying whether I'd buy it. No, no, but if business would help, which is the question. No, when I __ I speak not as a businessman, but as an ex-government employee, whenever proposals like that came up, one of the first things people see happen is government __ business and labor come in in lockstep, saying, "Horrors, horrors, the sky is falling." There's a commonality of interests there and people get used to what is, they get terribly conservative, and they know how to work the system the way it exists, and particularly the big unions and the big business, and they get very satisfied with it, they can manage it pretty well, and any time you try to unravel any kind of regulation or restriction or government intrusion, they're philosophically for it, but in the practical world, they don't want you to change the drill, they just figured out how to work this. Why should you then change it and make it all the more complicated. No, I think you'd get a good deal of reaction, just like you did out of the steel company in your television show. McKENZIE: And what would the international reaction, do you think, as an international economist. Supposing Milton got his amendment, constitutional amendment, which had that effect, how would other countries react to it? HUGHES: Well, I think Milton's fundamental example of why not be like Britain in the 19th century is wrong. Britain in the 19th century was THE industrialized country; it was well ahead of everybody else __ McKENZIE: Many decades ahead. HUGHES: __ many decades ahead of everybody else, and it was making larger profits, larger economic rents on its production, and it was doing it at very great cost to the workers in Britain. The workers in Britain were greatly exploited under those circumstances, and we don't want to go back to that. The international situation is much more complex, and countries __ there are countries at different levels of development, countries with different social systems, and countries with different social objectives, so I think that the solution, you know, is wrongly founded, and it's millenarian, it's utopian. I think that we have to think of a much more realistic process of discussions, negotiation, such as has taken place through that, to get to where we're going, without hurting the people who pay for the adjustment, and that is basically the workers, not the economists. RUMSFELD: Could I just comment briefly? McKENZIE: Yeah. RUMSFELD: I worry about the argument that because of the complexities of international relations, that therefore they must be planned and managed. By definition, we're not capable of managing the world economy. Each instance when we try to do it, it doesn't work out quite the way we intended. FRIEDMAN: I don't apologize for a moment for setting __ for being millenarian; because I think unless we know where we want to go, the timid steps that we take in that direction will go in the wrong direction. And if we're gonna go in the right direction, we ought to have a view. But I want to be sure to get down on the record a very strong objection to the statement of fact by Helen Hughes about 19th century Britain. I believe it is simply wrong. The workers were not exploited. The studies that have been done recently have shown over and over again that the 19th century was a period in which the ordinary English worker experienced a very rapid and very substantial rise in his standard of life. England did not stand alone. Japan had complete free trade for thirty years after the major restoration. Japan in more recent years has not. Japan in more recent years is not an example I would cite. But in its early years it had complete free trade. So I don't believe England stands alone. Now on the more __ McKENZIE: Politics of it. FRIEDMAN: On the politics of it, of course it's not politically feasible, why? Because it's only in the general interest and in nobody's special interest. Each of us is fundamentally __ has more concern with our role as a producer of one product than we have as a consumer of a thousand and one products. The benefits of a tariff are visible. Mr. Deason can see that his workers are quote "protected." The harm which a tariff does is invisible. It's spread widely. There are people who don't have jobs because of the tariff, but they don't know they don't have jobs. There's nobody who can organize them. Consumers all over are paying a little more for this, that and the other thing. They don't recognize that the reason they're paying for it is because of the tariff. The businessmen? I have never been in __ I'm not pro business. I'm pro free enterprise, which is a very different thing, and the reason I'm pro free enterprise __ RUMSFELD: Don't point at me when you say that. (Laughter) FRIEDMAN: No, no. I don't mean to point to you, Don. I point to the business community, because you are an exception. Because that __ McKENZIE: But he conceded there was a tacit alliance because that way __ FRIEDMAN: Oh there's __ McKENZIE: __to prevent you from achieving your purpose. FRIEDMAN: Oh, there's no doubt that there's such an alliance. In my opinion, the strongest argument for free enterprise is that it prevents anybody from having too much power. Whether that person is a government official, a trade union official, or a business executive. It forces them to put up or shut up. They either have to deliver the goods, produce something that people are willing to pay for, willing to buy, or else they have to go into a different business. McKENZIE: Well, there we must leave the argument for this week, and I hope you'll join us again for the next episode of Free to Choose. |

||

|

|